Insurance, insurance, insurance—I just can’t keep it straight! Do I need nineteen different coverages? My business is earth-moving, so I have excavation and construction equipment; should I be looking at a specific type of specialized insurance, rather than a lot of different kinds or just one or…help!

Let’s start at the beginning

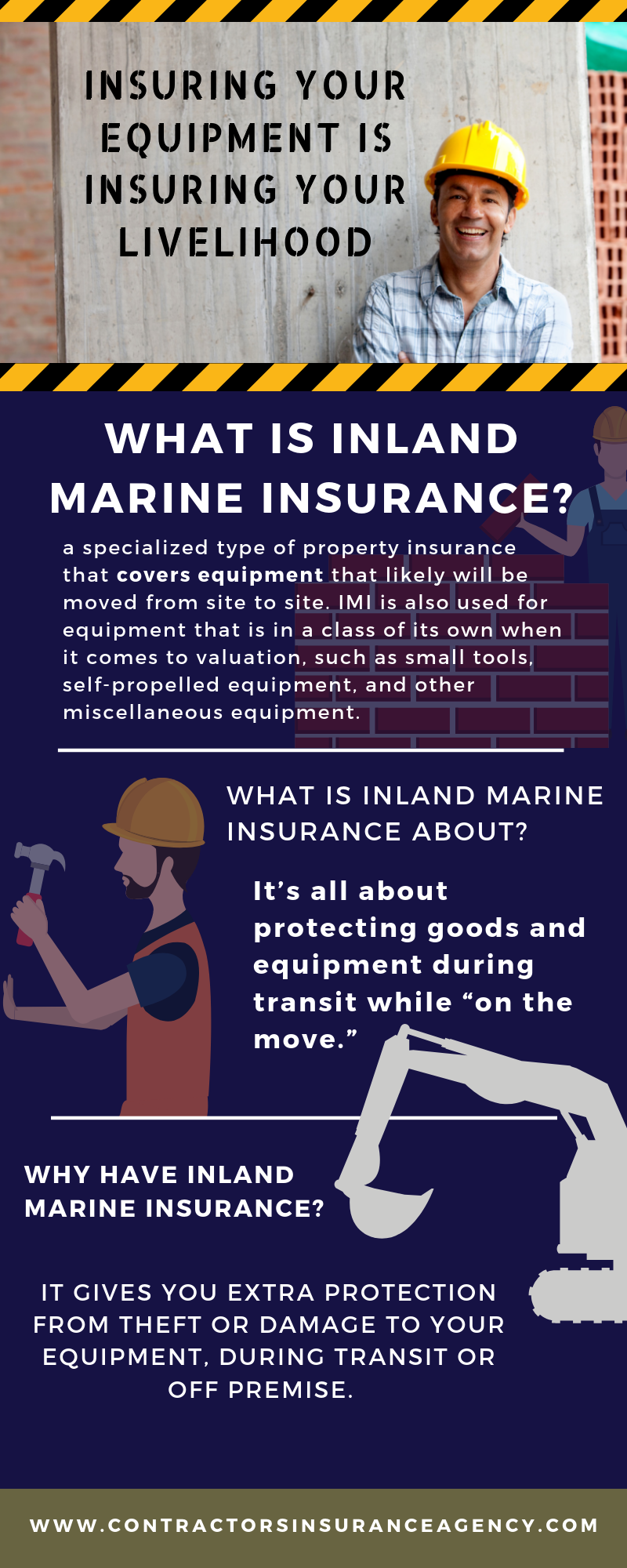

Inland Marine Insurance (IMI) is actually a type of property insurance, but a specialized type. Have you heard people talking about “equipment coverage”? Well, that’s this, just with another name. The reason why there’s a specific type of property insurance called Inland Marine Insurance is for coverage of equipment that is likely to be moved, as in from site to site. IMI is also used for equipment that is in a class of its own when it comes to valuation.

A quick (and short) history lesson

Long ago when companies were shipping goods overseas and shipping them via freighters or the like, this special insurance was created and called Ocean Marine Insurance. As times progressed and shipments started transporting in other ways, it was renamed to Inland Marine Insurance. It’s all about protecting goods during transit and “on the move.”

Even if you’re not in the construction business, Inland Marine Insurance is used to insure specific equipment that moves or has a unique risk, such as tools, cargo, even fine art! Though you wouldn’t think fine art would go in the IMI category, just imagine how it goes from museum to museum or gallery to gallery. There are so many types of “equipment” that move from location to location, ranging from construction equipment and cargo to even things such as musical instruments, medical equipment in mobile vans, even movie cameras. This is why some companies purchase both types of coverage.

So, now that we know what Inland Marine insurane is, let’s talk about why you should have it, or even IF you should have it.

One of the main reasons is that, although Inland Marine Insurance can be a bit more expensive than “simple” property coverage, it gives you extra protection from theft or damage, no matter where it’s been moved to. Most basic property coverages apply to equipment in a specific location—that’s where this differs.

Who needs it?

It really boils down to whoever has equipment of any type that will be moved or used in more than one specific fixed place. Some of the people who need IMI would be builders, installers, construction professionals and companies, excavators, and cargo transporters. Even art galleries, museums, IT, and mobile medical businesses need it. The list goes on and on.

If you fall into any of these categories, or simply have equipment that moves, then you need Inland Marine Insurance.

When you’re thinking about getting quotes from specialized IMI insurers, make a list for yourself as to your property’s value, both purchase and replacement (after-claim). Don’t neglect to list also total loss value. This is information you’ll want to have with you so you can determine which policy limits suit you best.

With your Inland Marine Insurance specialist, you’ll also consider whether a blanket or scheduled (items listed combined or separately, respectively) basis policy is best for you.

The Bottom Line

If your equipment, any of it, is likely to leave your primary insured location, then make sure you ask your John Scott Contractors insurance agent about Inland Marine Insurance and if you need it.

Feel free to leave a comment or ask any questions! Are you unsure if your business falls into this category? Our team is happy to answer any questions you may have about Inland Marine Insurance!